The psychology of investing in turbulent times

Make better investment decisions by understanding the psychology around the financial markets

While investment tools are more sophisticated than ever, we still have the brains of cavemen to some extent, and so transactions are driven by sentiment as much as economics. People often ask: ‘What’s your gut feeling?’ The idea of trusting our instincts is an appealing one, but how can we guard against these instincts being wrong?

The turbulent markets of late form a textbook setting for triggering tricky investor emotions and irrational decisions. Yet, the speed and complexity of today’s financial markets mean that a professional kind of detachment has never been more important.

‘Unless our process is absolutely clinical and based on objective analysis, we are exposed to the psychological flaw of being human,’ says AJB Wealth Managing Director Paul Willans. ‘Our very nature will impact on our decisions and how we implement them.

‘We’re also inclined to overestimate our skills and abilities relative to others – psychologists call it illusory superiority. Investors are no less prone to self-delusion when it comes to making investment decisions.’

The successful investor

A successful investor will not only understand the economic and market factors at play, but have an appreciation of the psychology around investment – how investors behave at different parts of the economic cycle.

‘The good news is that the markets are cyclical so we can learn from the past. It gives us a guide as to when we should guard against reckless enthusiasm, and when we should be prepared to dip our toes back in the water.’

Ten emotional stages of investment

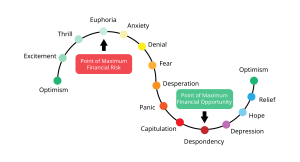

The Cycle of Market Emotions

The chart above illustrates the emotional stages that investors go through as markets rise and then fall over the course of the economic cycle.

1. Optimism

Prices are increasing, and investors are buzzing with excitement. They are likely to attribute any profits to their own investment skill, discounting the possibility that luck has played a part.

2. Excitement

Some investors stayed on the side-lines initially, but enter the market when stories of easily-made profits begin making the rounds (remember the technology boom in 1999-2000?). Stocks go up on a rising tide.

3. Thrill

Investors begin to believe that prices can’t possibly decline. Detailed fundamental analysis starts to go out the window.

4. Euphoria

Euphoria has spun out of control. Everyone’s talking about the stock markets, and investors are buying assets without even understanding what they are. There are many new listings.

5. Anxiety and denial

Then, inexplicably, prices begin to drop off, as some investors start to feel nervous and sell. However, other investors may feel indifferent, believing it to be a short-term correction, and saying, ‘I’m not worried because I’m a long-term investor.’ Others may even see the fall as a buying opportunity (Dismissal).

6. Fear, desperation and panic

After some heavy falls, there’s a general belief that the market is turning. Prices begin to plummet to levels that once again reflect fundamental prospects. Fear becomes widespread and, many previously successful investors have not only lost prior profits, but begin to get worryingly close to their initial investment capital.

7. Capitulation

This is followed by complete despair and capitulation. Investors are dumbfounded about how they could have been so wrong.

8. Despondency

Investors are so full of contempt for the situation that the idea of actually buying at bargain-basement levels, or indeed ever investing in shares again, is simply inconceivable.

9. Depression

When the market begins to recover, people are filled with doubt and suspicion, do not believe the recovery will be sustained. In fact, any pause in the recovery is seen as the start of a new collapse.

10. Hope and relief

Even when it is clear that share prices are fair value, there is reluctance to invest. Some will buy into the recovery story, but others will wait until the confidence stage comes around again before actually buying. And then, the cycle starts again…

‘Psychological influences can cause investors to ‘buy high’ during the thrilling and euphoric stages of the cycle, and ‘sell low’ at the panic and capitulation stages,’ explains Paul. ‘Buying high and selling low is not a winning strategy, but it takes skill and experience, or a high degree of bravery, to behave counter-intuitively.’

Or as Warren Buffet once said: ‘Be fearful when others are greedy and greedy when others are fearful.’

Where do you think we are in the psychological cycle?

If you’d like to explore your options, or arrange an obligation-free review of your investments, please contact us today.

AJB Wealth

3 East Street

Alresford

Hampshire

SO24 9EE